What Will Automotive Retailing Look Like in 2030? A future perspective on the possible & probable scenarios

Introduction

Slight disclaimer, I am putting forward my thoughts and perspectives on the future of automotive retailing in 2030, not based on specific research, but rather on my years in the industry, the evolutions we have seen already, and the disruptive shifts of this global pandemic that all will carry forward. It is also not possible in a short paper to encompass all of the entire changes, but rather tries to highlight some significant transformations.

More than anything, this perspective is based on the standing principle that the core business model of the way we buy and sell cars is not sustainable and survivable into the future. Something has to change dramatically. The industry will have to find new revenue sources, new offerings, and become part of a larger mobility ecosystem.

So, what are some of the possible changes and shifts we will see in 2030 in Automotive Retailing?

Overview

One of the most significant shifts in the future of auto retailing will be the very concept itself.

- Retailing will not mean just physical selling. It will not mean a transaction at the brick and mortar dealer storefront. The very idea of "automotive retailing" will come to be known as a valuable customer interaction or engagement through any channel, any time and any way.

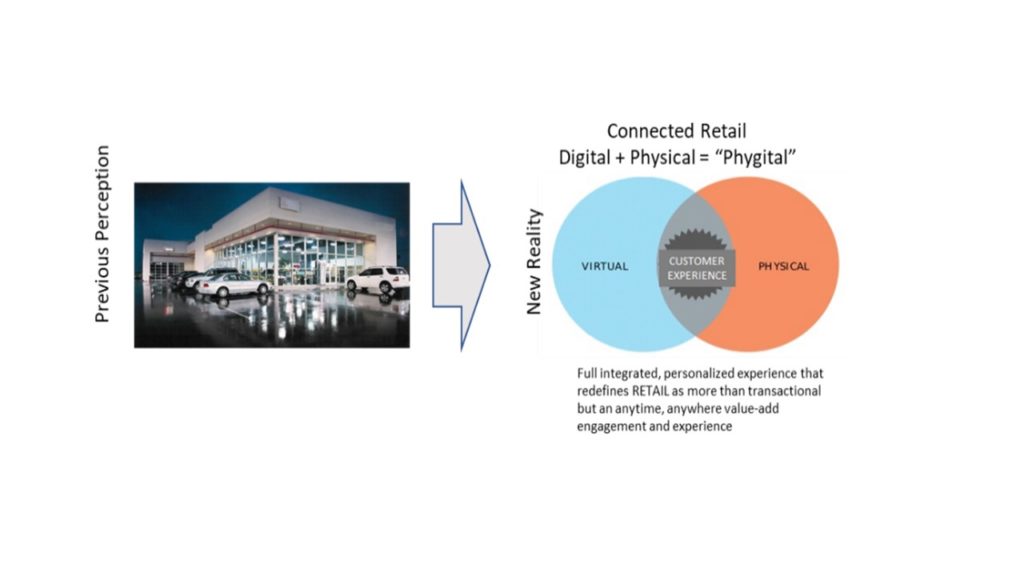

- The very differentiation of physical and digital will become blended. Retail will be all "phygital" (the intersection of digital and physical experiences), and merely an instance of experiences enabled through a customer journey.

- In addition, automotive retailing will not be centered around "selling" only, but be more inclusive of access and availability to experience products and services without a standard transaction of a new or used car as we know it today. It will include digital services, applications, brand attachment and engagement, and overall mobility platform access that is not about the sale of a physical product.

For the sake of trying to grasp a few major changes and shifts in 2030 for automotive retailing, I am going to twist the traditional sales cycle thinking into the "What," the "Where" and the "How" of what automotive retail consumers may literally not necessarily buy but "consume."

The What

To be clear, by the "what" I am referring to, what it is consumers will buy, or access, or consume. I firmly believe the idea of the industry being hinged to success or even survival as new car sales as the key success metric as a business model will not sustain.

In 2030, and already underway, I see the "what" being Access over Ownership. Consumers of mobility will want and need access to commuting, transportation, or personal mobility. This mobility may be in the form of a new or used car in the traditional sense. Still, it may also be in some form of new transportation modes (including autonomous, ride sharing, high-speed systems, public city and urban mobility, mini-car fleets, electric bikes, and more).

The" what" will be a more personalized mode of mobility options and platform of access. The ability to access on-demand or leverage in short-term durations and have more choices that meet the consumer needs will be the key driver of benefit and success to this new model.

The very "what" is the auto retailers and auto retailing will become about being a customer mobility network platform, and not about vehicle inventory, transactions, and mechanical service.

The Where

This one is likely easier for all of us to imagine. The "where" is anywhere and everywhere. It is wherever the consumer of mobility and retail engagement wants it to be. It is digitally driven, and the majority of the process of engagement, if not all of it, will be accessible with a few swipes of a screen.

But the "where" will also include the current dealer store and lot footprint. It will just be revamped to become more of a mobility access portal than just a blacktop of inventory (inventory station) and service bays in the back. The physical dealer in the future will contain other means of mobility accessibility, as described in the "what" above. The fleets of mobility access would include daily rentals and pay by the mile fleet availability, other forms of transportation such as autonomous and electric shuttles, e-bikes, and more. The "mobility center" (dealership) would also include electrification stations and the electrical shift from a car, or house, to powerplant and back as an exchange system and a means by which electric vehicle owners "make money" or transfer electricity as a value proposition.

In addition, the "where" of assessing future mobility options will include urban centers, shopping malls, and various pop-up or shared brand locations. In these venues, people would be able to "test drive" or demo options of future mobility in virtual and augmented reality and gamification platforms. This digital gamification and VR/AR options would also be available online via tablets and mobile phones as applications.

As for accessing the very mobility, this will include a much larger integrated footprint that is some cases, will include the OEM and dealer options and offers, but in other cases, be personal or city-owned options. These pick-ups, drop-off, and access centers could and will potentially include large parking lots, shopping malls, and other essential stadium and event venues, and in some cases, even smaller urban spots of convenience and high-volume easy access.

The short of it for "where" is that where must mean anywhere and everywhere for the future of retail, as I have redefined it. Retail and access to retail options such as mobility access and digital services will be "Phygital." Retail will not be constrained to a physical location or a specific function, but be omni-channel, personalized value for meeting customers' mobility needs.

The How

I have eluded to the "how" in the what and where sections, but the "how" will be consumer-centric and consumer-driven. The how to access mobility could and will include various models such as standard finance or lease transaction and include subscription possibilities, membership or license models, daily and monthly passes, pay per mile and pay as you go options, and many more creative on-demand means. Just as the future of retail and the future of mobility will be a more dynamic and open platform, so to will the access and economic models have to be more personalized and inclusive of options.

By many figures, the average household spends 10% or more of its net income on "subscriptions" currently. Those include streaming media services, gym memberships, cable and Internet access, and many other areas of our life. Why would our need for mobility not have such flexible, on-demand access? I know there have been some OEMs dabble in some form of a subscription model. Still, the retail level is where the consumer will be able to best physically and digitally interact with the available options and needs. I also don't want to blanket define "subscription" as just another fancy version of a lease. Whatever we may call it, the point is the "how" must be more dynamic, more flexible, more on-demand, and accessible anywhere and anytime.

We have not witnessed much in terms of new financial terms or economic models in the industry since the creation of leasing in the late 1990s. Surely there can be more creative means to leverage the OEM and dealer assets in a value-add and additional revenue source while improving the actual customer experience and customer engagement options.

Summary

All of the above is meant to merely lay out food for thought and the possible and, in many cases, probable new business models and customer expectation and needs that will be upon us in the next decade. As a dealer or retailer today, what do I do with this? Well, for me, it would strongly suggest and encourage that I have an eye on the future and start building my business model and capabilities to enable the new type of transformative experiences and offerings.

While still grinding at the core business, I would start to accelerate opportunities and capabilities such as:

- Deeper customer connections (better data, better personalization, more interactions, more engagement, and more value-add offerings)

- A customer network platform approach

- Build technology, data, and integrated systems and workflows to treat the customer in context in their journey through multiple channels.

- Identify and begin to leverage new "what" and "how" capabilities

- New business offerings such as mobile service, mobile delivery, customer apps, rental and fleet possibilities, servicing for P2P or car sharing platforms, other mobility options like e-bikes.

- Leverage creative financial and access models for customers to the transportation such as daily rates, subscription models, low and flex mileage leases, pay as you go, and more.

In all, start to redefine your own dealership as a mobility access center and not just an inventory lot. Start to measure success through customer engagement and experience. Create and measure new business offerings and services that expand your footprint in mobility with the customer and create new revenue opportunities.

It is coming. We can be part of it as a bigger ecosystem or slug away at diminishing business models and relevance. I believe the disruption we see now will only continue and accelerate and revamp the "what," "where," and "how" of automotive retail.

authored by

Dennis Ephlin

Dennis is the Head of Automotive Industry, Innovation & Transformation at Capgemini Invent. An innovative strategist and transformer, Dennis’ experience includes driving brand and customer strategy into market and profit realization.

Dennis is a change artist who creates tangible business value through ideation and visioning, creative marketing strategies and process implementations, strategic business transformation and customer understanding and delivery.

Get Curated Insights

Content worth the click

Related Articles