Let Data Be Your Guide: Navigating an Uncertain Sales Environment

There's no denying the automotive industry has had an impressive recovery from the early impacts of COVID-19. However, nearly a year after the initial shutdown, we also know that the landscape we're functioning in now is different than it was prior to the pandemic.

Having now survived two major downturns in the last 12 years, what's an automotive dealer to do? Not only do dealers want to understand how to adjust to the current landscape, but also how to anticipate changes so they can plan accordingly.

While there isn't a crystal ball that will answer all these questions, there is a powerful tool that can help dealers accomplish these goals: Data.

We know data can be overwhelming but looking at trends on both a macro and local level can inform strategies and guide implementation.

Looking at the big picture

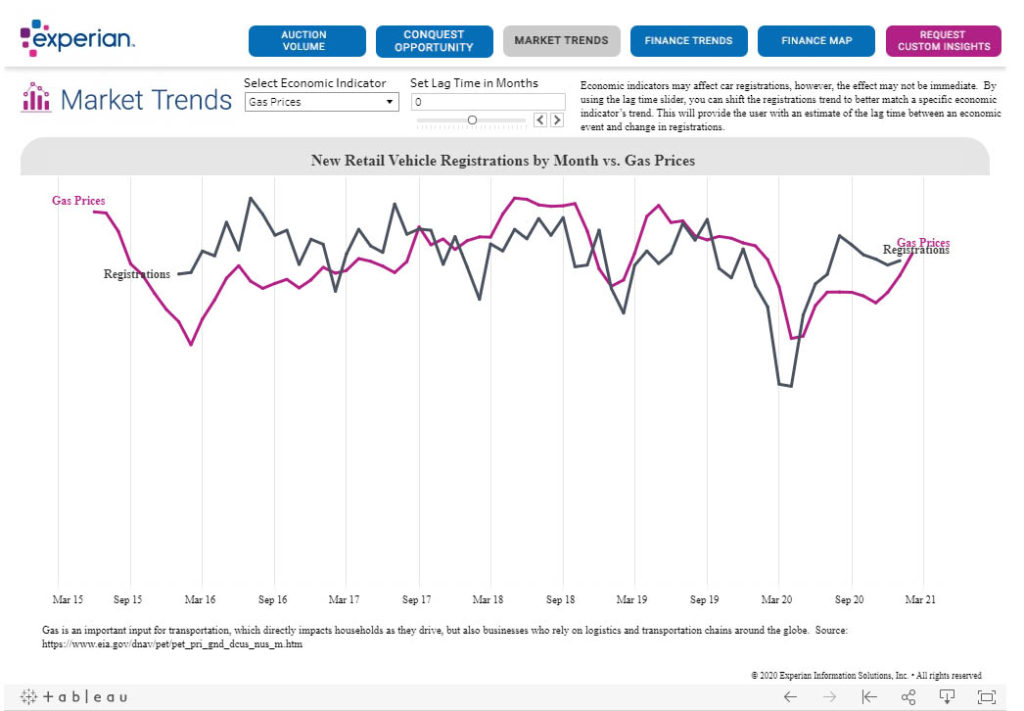

Take for example vehicle registrations. While there are seasonal ebbs and flows in registrations, what are the other factors that can impact volume? In Experian's new Automotive Market Insights dashboard, we layered in economic indicators with vehicle registrations over time to better identify any correlations, and a number of them emerged.

For instance, about a month after gas prices go down, vehicle registrations begin to increase. A good example of this was in February of 2016 when gasoline dropped to $1.89/gal, and vehicle registrations began to rise a month later. The trend works in the reverse, too. In October 2018, gas prices were at $2.92/gal, and then we saw vehicle registrations drop in November.

Applying this knowledge can help you identify how aggressive you need to be with marketing. You can ramp up as gas prices increase and then scale back as prices lower when people are more naturally inclined to purchase a vehicle.

This is just one example, but there are many. Layering vehicle registrations with additional economic indicators such as interest rates, unemployment, consumer sentiment can also be informative. Dealers who understand these correlations can then better anticipate shifts in the market based on paying attention to these economic trends.

Focusing on local

Of course, nationalized data will only take you so far. For dealers to be successful, you need to understand what the trends look like around your store, including the opportunities that already exist. This means going beyond your CRM database and looking for new customer acquisition strategies. One of the simplest ways to gauge opportunity exists around your store is to understand how many vehicles are coming off-loan or lease or moving into positive equity. Reaching consumers even before they're in the market gives you the opportunity to highlight why your vehicle could be a better fit for them before they even think about checking out the competition.

But that's not enough on its own — you need to know who your customer is, and what matters most to them. Layering in additional data can help pull these insights out. For example, Experian recently did a study that found millennials and Gen Z are the only age groups seeing growth in vehicle registrations. Even within these two age groups, there are differences in what and how they are financing.

Gen Z is more likely to finance a vehicle than millennials. Additionally, Experian's research found that older millennials (ages 40-33) are more likely to purchase passenger vans, while Gen Z tends to prefer sedans. Understanding these generational nuances can help tailor your marketing strategies with more relevant messages that resonate.

Data is only useful when it's used to draw out actionable insights. Looking at both macro and local trends will help you refine your strategies and implementation. Understanding the impact of economic indicators on vehicle registrations can help you adjust your strategies to better prepare for what's ahead. Localized trends will help identify who your customer is and what matters most to them. Ultimately, reliance on data will continue to help dealers manage the current environment and continue to move the industry toward recovery.

authored by

Amy Hughes

Drawing upon her years of experience in advertising research for national magazine publisher Time Inc. and Sinclair Broadcast Group, Amy has a passion for advancing the skill set of automotive marketers by helping them apply the latest enhancements in technology to their dealerships’ monthly advertising spend. Currently at Experian, Amy collaborates with dealers to transform their marketing operations through data. Previously, Amy was responsible for driving dealer sales and business development relationships for String Automotive and has been consulting with dealers on media and advertising for 15+ years.

Get Curated Insights

Content worth the click

Related Articles