Don't You Agree? Fundamental Questions Answered Regarding Dealership Compliance

"I don't have to agree, but I do have to comply," said an old employee and friend of mine named "Hank." He said it with a wry smile whenever he didn't agree with something I asked him to do. Then, he would do it because I asked him. And he would chuckle to himself.

So who really wants to comply?

No one, including your dog, when you tell him/her to "sit" or "stay." As humans, we find it distasteful to "comply" with what someone else tells us. However, lack of compliance will cost you in dollars, in publicity, and even in reputation.

While it may not be your favorite, a lack of compliance program will put you in the crosshairs. How can you get in trouble? Good question. Let's start with the biggest problem first.

If something criminal happens in your store, and you don't know about it, pleading "unaware" or "ignorant" of the situation is an ineffective defense. Chapter 8 of the Annotated 2018 United States Sentencing Guidelines states clearly:

"This chapter is designed so that the sanctions imposed upon organizations and their agents, taken together, will provide just punishment, adequate deterrence, and incentives for organizations to maintain internal mechanisms for preventing, detecting, and reporting criminal conduct."

It continues:

"The two factors that mitigate the ultimate punishment of an organization are: (i) the existence of an effective compliance and ethics program; and (ii) self-reporting, cooperation, or acceptance of responsibility."

So, if you would like to avoid serious problems, you should have a robust compliance program and, according to the Consumer Financial Protection Bureau (CFPB), a Compliance Management System.

Furthermore:

"These guidelines offer incentives to organizations to reduce and ultimately eliminate criminal conduct by providing a structural foundation from which an organization may self-police its own conduct through an effective compliance and ethics program."

How do you provide a structural foundation?

First, you must decide you are committed to implementing a robust compliance program and stick with it. It's a paradigm shift that would likely change some of the operations of the dealership. Embrace the change.

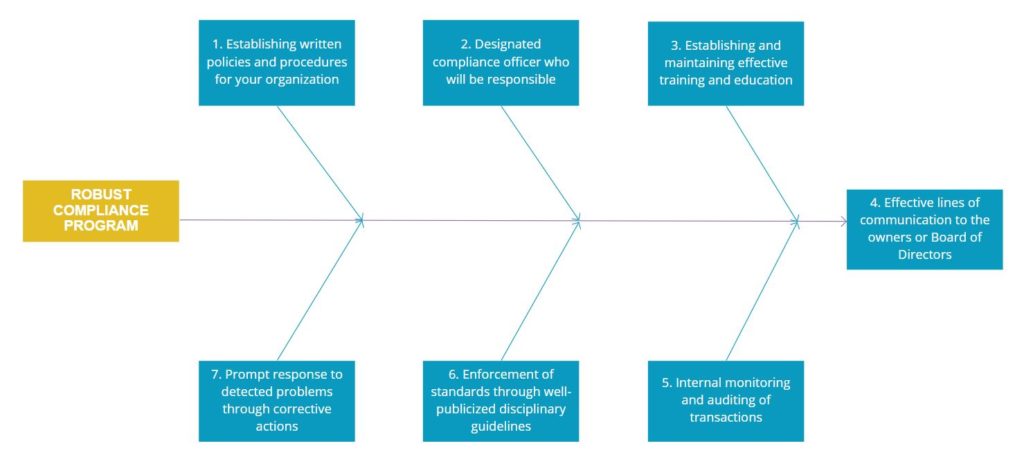

There are seven components of a robust compliance program:

These seven (7) are clearly important. The dealer/owner(s) must participate here, or the whole program falls apart, and nothing is achieved. Alternatively, third parties can handle these functions if the dealership does not want to take on the time commitment or the responsibility. Bottom line? Someone has to do the work of compliance, or you open yourself up to liability.

Do You Know Your Penalties?

Here are additional examples:

IRS/FinCEN Form 8300. This is the cash reporting requirement for notifying the IRS of any payments in excess of $10,000 cash (though there is tremendous nuance to this law).

The IRS website says:

"A person may be subject to criminal penalties" for -

- Willfully failing to file a Form 8300,

- Willfully filing a false or fraudulent Form 8300,

- Stopping, or trying to stop, a Form 8300 from being filed, or

- Setting up, helping to set up, or trying to set up a transaction in a way that would make it seem unnecessary to file Form 8300."

Penalties depend on total revenue but are "not to exceed $3,339,000 per calendar year." And criminal penalties include "imprisonment (for) up to five years, plus the costs of prosecution."

Make sure you include various forms of cash and count it as cash: travelers checks, cashier's checks, or bank checks with no lien recorded. These can all be considered "cash" in the eyes of the IRS.

How does the Fair Credit Reporting Act impact dealers?

Let's just focus on one item within this complex law. Are you sending a denial letter to every person in the dealership whose credit you pull? You are supposed to send a letter stating the dealership itself is not extending credit to the borrower and there is a third party who is providing financing. There is safe harbor language you are to use according to the code. "Safe harbor" refers to the exact phraseology that the law requires you use. Omission of this language is a serious "no no." Penalties for willful or negligent non-compliance may include actual damages, punitive damages, and plaintiff's attorney's fees.

Hank was right. You don't have to agree, but unless you want to open your checkbook, you do have to comply.

Tom Kline

DMM Expert

A dealership franchise owner for thirty years, Tom is now the Lead Consultant & Founder of Better Vantage Point, providing Dealer Dispute, Compliance and Risk Mitigation Solutions.

Tom also spearheads Tuck The Octopus which helps dealerships proactively manage governance, risk and compliance which has a direct impact on the customer experience.

Get Curated Insights

Content worth the click

Related Articles