3 Years of Hispanic Car Buying Preferences Trends

In my last article, I touched on a few trends that we are starting to see after 3 years of doing our Hispanic Car Buying Preferences surveys.

This article will dig into the data to see if we can surface more details about the topics I covered in the last post, and add some additional trending data that was not discussed. Please note that in some cases, the data is only available for the final 2 years since we’ve been refining the survey as we go along. Let’s get started!

Reputation

A dealer or manufacturer’s reputation is critical for their ability to sell in general, and sell to the Hispanic market in particular.

Top 3 Favorite Brands

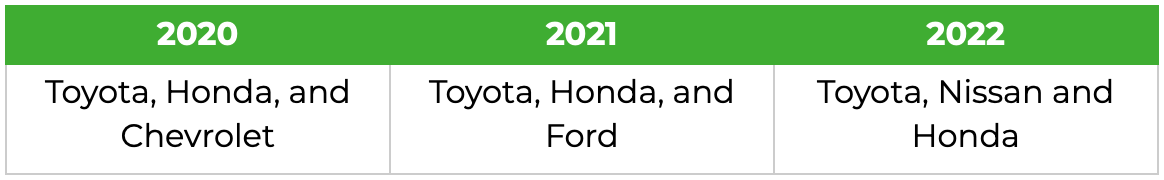

Fortunately for this section, we asked the same question for each of our 3 years conducting our surveys. When we asked our respondents for them to rank their top 3 favorite automotive brands, the said the following:

Notice a trend here? Toyota holds the #1 position all three years in a row? Why? Toyota, of all the manufacturers, has a well established history of consistently marketing to the Hispanic community. Here’s a news article from NPR from back 2011! Spend a moment surfing and you will find this same commitment to multicultural outreach continues to this day. No surprise that Toyota is consistently popular and effective at capturing the Hispanic market. This statement is no disrespect to the other brands, but consistent commitment works.

Hispanic Referrals

Next in our lineup is a look at the question, “How likely are you to refer a customer to a dealer who speaks in Spanish AND treats you well?”. We asked this question in 2021 and 2022. What we discovered is that the trend dipped down between the two years. In 2021, 79% said that they were Very or Extremely Likely to refer someone if the dealer spoke Spanish and treated them well while in 2022, that number dropped to 68%. What this tells us at this point is that we’ll need to ask the question again in 2023 to see where the responses trend.

Advertising and Social Media

Now we get to delve into US Hispanics’ attitudes about bilingual advertising, social media, and the search methods they use to hunt for their next vehicle.

Advertising

So, when we asked, “How likely are you to visit a car dealer who advertises in Spanish?”, the results were a bit odd over the period, varying unpredictably. However, overall, the data suggests an upward trend, especially with the big jump in 2022 AND if one takes into consideration that the 2020 and 2021 advertising answers might be skewed by COVID related attitudes during that time period. Speculation aside, this is a very important question since it gets to the ultimate question of why dealers who don’t advertise in Spanish should consider doing so. If you just did some messy math and averaged the results over the 3 years, you would see that over half (or roughly 54%) of the respondents see Spanish language advertising as valuable. That’s still a mighty big chunk of people, especially for dealers who have large Hispanic populations around their dealerships. Conclusion: Outreach = money.

Travel Further to a Dealer that Advertised to You in Spanish?

Now let’s look at the impact of Spanish language advertising in the community and how it might influence behavior. For 2021 and 2022, we asked shoppers if they would travel further to a dealer who advertised to them in Spanish and the results were significantly different between the two years. For 2021, only 43% gave a positive response, while in 2022, 74%, nearly double, had the same answer. Since a picture is worth a thousand words, here you go:

2 Most Popular Social Media Platforms

One question that we’ve started to explore is which social media platforms rank highly for Hispanic shoppers. When we asked the simple question, “Which are your two most favorite social media platforms?”, the breakdown showed a consistent pattern between the two years with Instagram in first, YouTube second, (and Facebook third). This data, especially if it is supported in our upcoming 2023 survey, tells us where we might focus our digital outreach when targeting Hispanic shoppers.

Top 2 Online Resources for Doing Research

As we all know, everybody uses a range of resources to conduct online research. For Hispanic shoppers, what happened when we looked at the question, “Which online sources are you likely to use when you research buying a car, truck, or SUV? (Check all that apply)”? Since we didn’t ask this question in 2020, we lack it here, but for 2021 and 2022, the data speaks for itself. In short, it is consistent from year to year: Search Engines were first, dealer websites second. What does this mean? Simply put, you should make sure that your website ranks well organically (while taking care in spending some money to boost that ranking). Next, you should make sure that your website is easy to use for Hispanic shoppers. A mix of English and Spanish would be wise, especially if your Spanish copy is customized to the dominant Spanish sub-culture in your area (for example, people of Mexican origin).

Do You Want a Test Drive?

The test driving data is quite interesting and it merits further study. We asked this question all 3 years and found that there is a big difference between 2020 vs 2021 and 2022. Here’s what the data looks like in a nice little bar graph. As you can see, there is a clear upward trend for Hispanic car shoppers when asked, “How important is it for you to test drive a vehicle before you buy it?”. What’s notable, and not seen in the data here, is that a vast majority of Hispanic women think that a test drive is very important. This should tell your sales people to think about this fact when an Hispanic woman contacts them about purchasing a vehicle.

Buy Online… or Not?

COVID, most certainly, accelerated a change in public attitudes and behavior regarding digital retail. Consequently, for 2021 and 2022 we introduced a question so that we could trend Hispanic car shoppers’ attitudes toward online car shopping over time. For both years, we asked, “How likely are you to buy your next automobile online?”. Here’s what we found out:

Notice something here that we did differently? The blue column represents 2021 respondents where only 12% said that they were Moderately, Very or Extremely Likely to buy online. The red and orange columns, on the other hand, are 2022 results but separated by one response. For Year 2022, we just included Extremely or Very Likely responses (at 23%), while Year 2022+ includes all three (jumping to 43%). We provided the visual distinction so that you could see the difference between those who felt strongly about digital retail in 2022 vs those who were wishy-washy about the subject. Regardless, the data shows us that attitudes started shifting heavily about only car buying from 2021. It also tells us that there is a portion of Hispanic shoppers that will buy online. In 2023, we plan to see how these attitudes shift with income. Now, that will be fun!

Data Whisperers

Listening to data is important; acting on it is even more important. This is why we love using data to inform our decisions, and those of our customers. All of the trending we see above lacks sufficient data for certainty, but it does whisper to us certain things that are happening in the market.

First, brand reputation is always important, but Toyota does a consistently great job at promoting a good reputation in the Hispanic community while Honda, Chevrolet and Ford compete for lower rankings. The OEM that rivals Toyota will be the one that makes multicultural marketing an everyday part of doing business, not a cool idea to pursue on the side.

Second, Spanish language advertising is important to US Hispanics. Even though the positive responses to the question took a dip in 2021, it is clear that a growing majority see it as valuable. And, if you include the very positive behavioral element of whether Hispanics would travel further if a dealer advertised to them in Spanish, advertising becomes even more important. Don’t advertise at your own risk, or to put it differently, don’t let your competitors steal business from you because you’re not advertising to the community.

Finally, while covered only lightly above, Hispanic women hold some very strong opinions in contrast to men. We see this in the case of test drives where 100% of women thought that test drives were very important in contrast to roughly half the men. We saw this same division elsewhere on other questions, such as the question about whether an Hispanic shopper would travel a distance to shop from a dealer who marketed to them in Spanish. Again, women held strong with a 100% vote for Very and Extremely Likely while men were much less committed.

With all that said, let’s wrap up on this point: The data revealed by the three annual surveys is very important if you want to develop a nuanced marketing message to your local Hispanic community. For 2023, more data is needed to suss out attitudinal trends over time. This means that we’re REALLY looking forward to 2023’s results, with the survey outreach planned to start at the end of this month.

Should you wish to contact us about these surveys, or other data, you can find about our services via surgemetrix.com, or contact me via [email protected], or 954.507.6468.

Adam Dennis

DMM Expert

With over two decades of experience revolutionizing the automotive industry, Adam leads SurgeMetrix who, through Bilingual Marketing Strategies, AI powered SEO, Market Intelligence Analytics, & Cybersecurity solutions, help dealerships build new markets.

Focused on data - finding it, understanding it, leveraging it and protecting it - Adam is invested in providing solutions which help dealers make informed decisions about how best to sell cars.

Get Curated Insights

Content worth the click